Easy Markets Review

With this EASYMARKETS Review we want to understand if Easy Markets is really one of the best Australian Forex Brokers and the most suitable for beginner. We conducted an in-depth review to find out the answer and bring it to you! Recently has been included by Engine Forex among the Australian Forex Brokers, Best Forex Scalping, ASIC Forex Brokers, CySEC Forex Brokers, Best Forex Brokers for CFD Trading, Best Gold CFD Trading Brokers.

easyMarkets was founded on the idea of democratising trading. It was initially established as Easy-forex in 2001 but has undergone a rebranding to easyMarkets in the year 2016.

Their headquarter is located in Limassol, Cyprus and the firm holds further international offices in Sydney, Australia as well as Majuro, on the Marshall Islands.

easyMarkets managed to democratise trading, make it accessible and more accessible to all types of clientele. They were the first “to offer a true online trading platform where traders could not lose more than what they invested”.

- Forex Platform: MetaTrader 4 or EasyMarkets

- Head Office: Sydney, Australia

- Founded: 2001 As Easy Forex

- Reviews: 9.9 - 610 Reviews Trust Pilot

- Trade Protection: Deal Cancellation

- Spreads: Fixed Spreads

- Analysis: Free SMS alerts

- Minimum Deposit: $200

- Crypto: Bitcoin

Our Rating: 8

Trading Conditions

| Max Leverage: | 400:1 |

| Platform: | |

| Min Deposit: | $100 |

| Spread: | From 1.8 Pips |

| Cuts out Dealing Desk: | No |

Methods of deposit and offers

| Deposit / Withdraw: | |

| Welcome offer: | Up to 20% 1st deposit bonus |

| Rebates Engine Forex: | Coming soon! |

SECURITY

In Summary

ASIC & CySEC licensed & regulated

High-level web security

Top-notch risk management tools

easyMarkets is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC) and holds further licenses by MiFid in Europe.

Even though most investors are primarily interested in the offer and the conditions of online broker, our experience has shown that the question of seriousness and trustworthiness should also be clarified. The best offer is of little use if the provider does not handle the money entrusted to him responsibly. If basic standards are not complied with, the investor always runs the risk of losing his deposits. Besides, it is, of course, important to know that a fair settlement of the trade can be assumed.

The online broker easyMarkets holds an office in Cyprus so that European regulations apply here. The regulatory authority CySec ensures that these are also complied with. Against this background, the company must comply with European consumer protection regulations. This includes giving the highest priority to fair treatment and the protection of deposits. For example, products must be presented as transparently as possible so that customers can identify opportunities and risks. Negative balance protection is another factor EU-licensed brokers need to provide to their clients. Due to these extensive specifications and measures, customers can feel safe with easyMarkets.

All clients’ funds are kept separate from the company’s and are securely stored in segregated trust accounts. The company guarantees that client funds are never used for operational or investment purposes and further offers their clients negative balance protection.

easyMarkets’ proprietary trading platform features top-notch risk management tools and applications such as deal cancellation, Freeze Rate and Free Guaranteed Stop Loss and Take Profit, which influenced the Forex industry as a whole and helped to protect customers and their funds in new ways.

Spreads Comparison

CHARGES AND MARGINS

In Summary

Two platform to choose from

Fixed spreads from 1.8 pips

Up to 400:1 leverage

Minimum deposit $100

easyMarkets offers two trading account types which can be accessed via two trading platforms: easyMarkets own proprietary trading platform and the classic and world’s favourite MetaTrader 4 platform.

The minimum deposit requirement is set to $100, and there are no minimum requirements for withdrawals (only for withdrawals to bank accounts a minimum of $50 is needed).

Clients can select from more than 200 financial instruments of six asset classes in total, with more than 100+ currency pairs, 22 metals, 12 commodities, 15 stock indices, 28 options and 3 cryptocurrencies (BTC, ETH and XRP).

Leverage can be set as high as 400:1 for most Forex pairs and the most popular metals. Leverage on commodities and indices is varying depending on the asset with a maximum of 100:1. Cryptocurrencies can be leveraged 10:1 except Bitcoin, where the leverage of up to 20:1 can be applied.

easyMarkets is a market maker broker and doesn’t offer the lowest spreads on the market. However, spreads are tight and still at a competitive level and start at 1.8 pips (for example on the favourite EUR/USD pair and AUD/USD). Since they are a market maker, no additional commissions are charged – the spreads include the fees.

TECHNOLOGY

In Summary

Solid trade execution

easyMarkets trading platform

MT4 platform

NDD or STP

Since their beginnings, in the year 2001 easyMarkets has been focussed on offering cutting-edge and innovative products, tools and services to their clients.

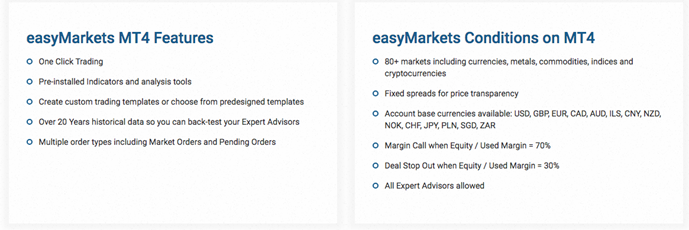

Regarding trading platforms, traders have the choice between easyMarkets’ very own proprietary platform that offers unique tools and features and impresses by its ultra-user-friendly functionality and the Forex industry’s favourite MetaTrader 4.

All the underlying securities on offer can only be traded with the easyMarkets platform, while the selection in MetaTrader 4 is slightly limited. The in-house trading software enables spot trading as well as fixed spreads and guarantees that no slippage occurs. The platform also offers the dealCancellation feature and guaranteed stop loss.

Despite the broker acting as a market maker, experienced traders looking to use the scalping trading style are welcome at easyMarkets.

The easyMarkets’ platform is available as a mobile app for both Android and iOS devices, as well as a webtrader platform. The platform is packed with stand-out, integrated analytical tools such as deal cancellation, Freeze Rate and Free Guaranteed Stop Loss and Take Profit.

Those who prefer MetaTrader 4 for mobile trading can download the free MT4 mobile app for iOS and Android devices.

MT4 is also available on most common devices and as a web terminal. It offers one-click-trading, pre-installed indicators and analysis tools, multiple order types and the support of EAs (Expert Advisors).

Execution of Speed Comparison

CUSTOMER SERVICE AND CLIENTS SUPPORT

In Summary

24/7 customer support

200+ financial instruments

Multi-award winner

Standard account & VIP account

easyMarkets customers have access to award-winning 24/7 support via telephone, live chat, Facebook Messenger, Viber and email.

easyMarkets operates on a very simple yet profound credo: “Simply honest”. They pride themselves in being one of only a few online Forex brokers that genuinely offer full transparency and a straightforward and honest approach in everything they do and offer.

Overall more than 200 financial instruments of six asset classes are accessible with more than 90 currency pairs, 22 metals, 12 commodities, 15 stock indices, 28 options and 3 cryptocurrencies (BTC, ETH and XRP).

Clients can take advantage of a sign-up promotion that either gives 20% or up to a $2000 tradable bonus based on the first deposit.

VIP clients gain access to specific benefits and innovative trading conditions with the easyMarkets VIP account. Tighter fixed spreads, a full suite of real-time technical analysis tools and access to a personal VIP market analyst are granted to VIP clients that deposit a minimum of $10,000.

All traders can further access easyMarkets’ unique “Learn Centre” that provides a large selection of educational material such as webinars, tutorials, videos, eBooks a decent FAQ section and more!

Market news, live currency rates, a financial calendar, etc. are all available within easyMarkets’ website easymarkets.com.

A demo account version is further available to test the broker’s trading conditions and range of products.

Available deposit options include:

- credit cards and debit cards (Mastercard, Visa, American Express, Maestro and JCB)

- Sofort

- iDeal

- Giropay

- Webmoney

- WeChatPay

- Bank transfer

FOREX AND OTHER TRADING OPTIONS

In Summary

100+ currency pairs & 3 cryptos

22 metals

12 commodities & 28 options

15 indices CFDs

For the most part, currencies, commodities and indices can be traded. Shares, on the other hand, are not available. easyMarkets offers more than 200 financial instruments of six asset classes in total, with more than 90 currency pairs, 22 metals, 12 commodities, 15 stock indices, 28 options and 3 cryptocurrencies (BTC, ETH and XRP).

The trading offer is broadest in the area of currencies and currency pairs (Forex trading). Initially, 135 different currency pairs are available for trading. This number alone shows that the range of tradable combinations goes far beyond the known majors. But of course, the combinations of the most important currencies like US Dollar, Euro, Japanese Yen and British Pound can be traded first. Besides, the Scandinavian currencies are available in various combinations. The Polish zloty, the Turkish lira or the South African rand can also be traded. A distinctive feature of the easyMarkets offer is that so-called vanilla options can also be bought and sold via the platform. The four majors and many other currencies, as well as raw materials, can also be accessed.

The selection of raw materials is also extensive. For the sake of clarity, these are subdivided into energy, agriculture and metals, with more than five values available in each segment. This means that different types of oil can be traded, as can natural gas. In the case of agricultural products, grain, cotton, cocoa, sugar or wheat, but also soybeans are on the price list, and among the precious metals, palladium, copper and platinum are available in addition to gold and silver. The metals can also be traded in different currencies.

Finally, we take a look at available stock exchange indices, which in our experience are also very suitable for leveraged trading. This is because, unlike equities, less severe price fluctuations are to be expected here, which makes them much more predictable for trading. The available indices offer investors a vast range of investment opportunities. In this way, the values of different countries and regions of the world can be used. The indices of all leading economic nations such as Japan, Germany, Great Britain and, of course, the USA are available. Besides, the leading index of China and Switzerland are offered for trading. All in all, our experience shows that investors who want to specialise in trading currencies, commodities and indices have the very best prerequisites with easyMarkets.

At this stage, the top three cryptocurrencies can be traded with easyMarkets: Bitcoin, Ethereum and Ripple’s XRP.

easyMarkets offers maximum leverage up to 400:1, micro-lot trading starting from 0.01 lots and tight, fixed spreads from 1.8 pips. The minimum deposit requirement is set to $100.

SPECIAL FEATURES

In Summary

Popular MT4 & own proprietary easyMarkets platform

Fast execution speeds

Tight spreads starting from 1.8 pips

Innovative technology & RM tools

easyMarkets offers tight, fixed spreads starting from 1.8 Pips (for example on the favourite EUR/USD pair and AUD/USD) and high leverage of up to 400:1.

More than 200 tradable financial instruments of six asset classes.

Cryptocurrency trading featuring Bitcoin, Ethereum and Ripple’s XRP.

Top-notch, innovative technology, solid order execution and a stable trading environment are given.

Most trading styles, such as Expert Advisors (EAs), scalping and hedging are allowed.

easyMarkets’ proprietary platform, as well as Metatrader4, are available as trading platforms.

Stand-out, integrated and unique analytical tools such as deal cancellation, Freeze Rate and Free Guaranteed Stop Loss and Take Profit are available on the easyMarkets platform.

Max Leverage Comparison

easyMarkets is a multi-award-winning market maker broker with many stand-out attributes and features. Their very unique proprietary easyMarkets platform is jam-packed with innovation, tools and features that can be utilised by any type of trader.

Their excellent customer service and overall offering makes them a good choice for CFD and Forex traders. Customers interested in share trading, investing in ETFs, mutual funds or a wider range of cryptos need to select a competitor broker with a wider product portfolio.