Scope Markets Review

Is SCOPE MARKETS a good Forex Brokers? We conducted an in-depth review to find out the answer and bring it to you!

Our Scope Markets review shows that ScopeMarkets.com is a trading name of Scope Markets Ltd. Financial Services are provided by Scope Markets LTD, a Forex broker headquartered in Belize.

The firm’s management team has experience of over 50 years within the financial services industry, primarily in dealing Forex trading and CFDs.

Scope Market is a highly client-oriented company with strong core values of transparency, honesty and candidness at all levels.

- Forex Platform: MT4 + cTrader

- Head Office: Melbourne, Australia

- Founded: 2010

- Reviews: 9.1 – 8.6 - 427 reviews Trust Pilot

- ECN Forex Trading: Razor Account

- Spreads: From 0.1 pips

- Leverage: 500:1

- Cryptocurrency: 4 Crypto

- Guaranteed Stops: No

Our Rating: 8.5

Trading Conditions

| Max Leverage: | 500:1 |

| Platform: | |

| Min Deposit: | $500 |

| Spread: | From 0.0 Pips |

| Cuts out Dealing Desk: | Yes |

Methods of deposit and offers

| Deposit / Withdraw: | |

| Rebates Engine Forex: | Coming soon! |

SECURITY AT SCOPE MARKETS

In Summary

- IFSC regulated

- True ECN broker

- No dealing-desk intervention

- Risk Management tools

The Scope Markets Ltd is authorized, regulated, registered and is a member of the International Financial Services Commission of Belize (IFSC).

All clients’ funds are kept separate from the company’s and are securely stored in segregated trust accounts. The company guarantees that client funds are never used for operational or investment purposes.

The Scope Markets Ltd is authorized, regulated, registered and is a member of the International Financial Services Commission of Belize (IFSC).

Spreads Comparison

CHARGES AND MARGINS AT SCOPE MARKETS

In Summary

- Spread mark-up or

- Commissions per standard lot round-turn

- Up to 500:1 leverage

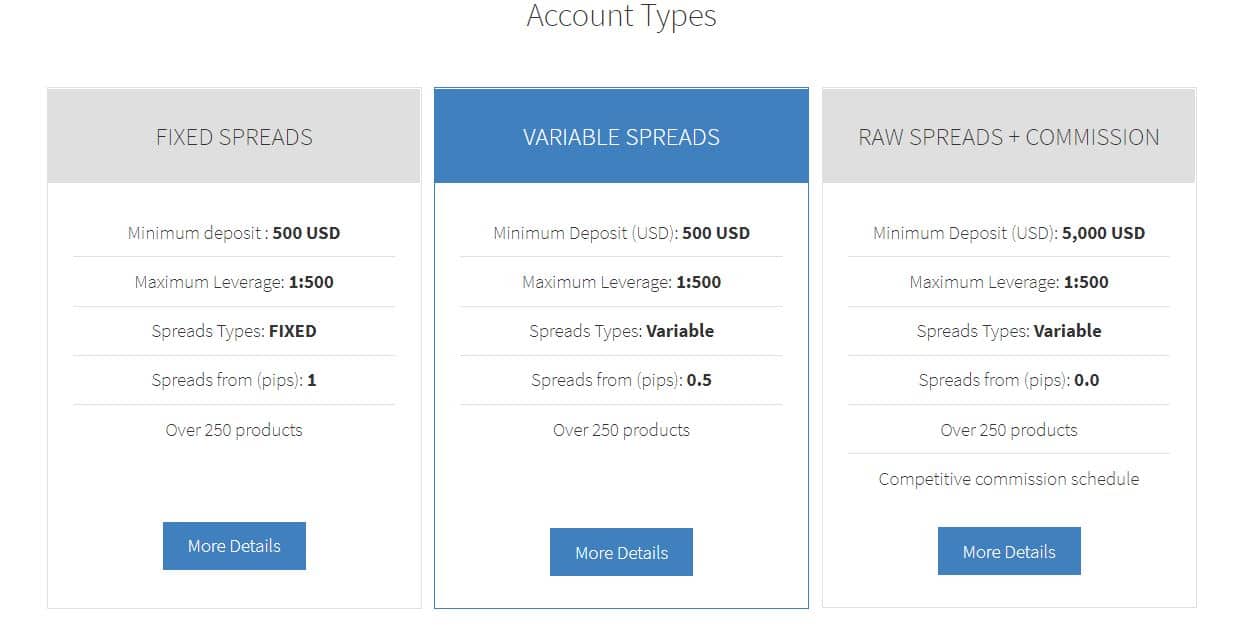

Scope Markets offers three different account options: Fixed Spreads, Variable Spreads and Raw Spreads. Available trading platforms include the widely used MetaTrader4 (MT4) and MetaTrader5 (MT5) as well as Scope Markets own proprietary platform GT.

Margins depend on the traded instrument. Margin calls are typically made at 50% with Margin Stop Outs at 10%.

The minimum deposit requirement is set to $500 and there are no minimum requirements for withdrawals.

Clients can select from more than 250 financial instruments including Forex, indices, energies, shares, metals and cryptocurrencies.

Leverage can be set as high as 500:1 on all three account types.

Spreads start from 0.0 pips on the Raw Spreads account. On their Variable Spreads account they start at 0.5 pips and 1 pip on the Fixed Spreads account.

TECHNOLOGY

In Summary

- Reliable trade execution

- True ECN broker

- MT4 & 5

- Scope Markets GT

Scope Markets offers online trading on the popular and widely used MetaTrader4 (MT4) and MetaTrader5 (MT5) trading platforms as well as Scope Markets own proprietary platform GT.

All common benefits of MT4, such as the use of trading robots known as Expert Advisors (EAs), different charting types, wealth of technical indicators, automated trading, one-click-trading and more are available with Scope Markets’ MT4.

The MetaTrader 5 is an advanced multi-functional trading platform which offers superior tools for comprehensive price analysis and robust trade execution. This platform also allows users to create and install their own or third party algorithmic trading applications (EAs).

The in-house platform Scope GT is a multiple thread trading platform which offers any commodity in the derivative markets. This trading platform is equipped with common order types to follow up markets, hedging and confirmation tools such as email or notification for executions and any other request, customized reporting modules, margin off-set for spot and forward positions, span margin application for different OTC products.

All three platforms are available for download on most operating systems as well as mobile Apps for iOS and Android devices.

The in-house platform Scope GT is a multiple thread trading platform which offers any commodity in the derivative markets. This trading platform is equipped with common order types to follow up markets, hedging and confirmation tools such as email or notification for executions and any other request, customized reporting modules, margin off-set for spot and forward positions, span margin application for different OTC products.

Execution of Speed Comparison

AN OVERVIEW OF SCOPE MARKETS' CUSTOMER SERVICE AND CLIENTS

In Summary

- 24/5 customer support

- Licensed & regulated with the IFSC

- 3 account types to choose from

Scope Markets customers have access to professional 24/5 support via telephone, live chat, and email.

Three different account options are available: Fixed Spreads, Variable Spreads and Raw Spreads. Here’s a quick overview of these account types:

Overall more than 250 financial instruments of six asset classes are accessible including currency pairs, indices, energies, shares, metals and cryptos.

Deposit and payment methods include VISA, Mastercard, Neteller, Skrill and Bank Wire Transfer.

Clients can start trading with a live or demo account.

Traders and investors from Afghanistan, Cote d’Ivoire, Cuba, Iran, Libya, Myanmar, North Korea, Sudan, Puerto Rico, USA, Syria, and Ecuador are not accepted at Scope Markets.

FOREX AND OTHER TRADING OPTIONS AT SCOPE MARKETS

In Summary

- 30 currency pairs

- 7 cryptocurrencies

- Metals, indices & energies

- Share CFDs

Scope Markets offers more than 250 financial instruments of six asset classes.

Traders can choose to trade on the above mentioned options including some of the world’s top markets, the foreign exchange market and shares from the US, Germany, UK, France and Spain.

At this stage, the some of the top cryptocurrencies can be traded with Scope Markets: Bitcoin, Ethereum, Ripple’s XRP, Bitcoin Cash, Litecoin, Monero and Zcash.

Scope Markets offers leverage up to 500:1, micro-lot trading starting from 0.01 lots and tight spreads from 0.0 pips (depending on the selected trading account option). The minimum deposit requirement is set to $500.

SPECIAL FEATURES OF SCOPE MARKETS

In Summary

- True ECN broker

- MT4 & 5, Scope GT platforms

- Tight spreads & leverage up to 500:1

- Promotions

Scope Markets offer very tight spreads starting from 0.0 pips on their Raw Spreads account.

Maximum leverage is 500:1.

More than 250 tradable financial instruments of six asset classes are available.

Cryptocurrency trading featuring Bitcoin, Ethereum and Ripple’s XRP, Bitcoin Cash, Litecoin, Monero and Zcash.

Most trading styles, such as Expert Advisors (EAs), scalping and hedging are allowed.

Available Forex trading platforms include MT4, MT5 and their own proprietary platform Scope GT.

Scope Markets offers tight spreads from 0.0 pips and leverage up to 500:1.

Max Leverage Comparison

OUR CONCLUSION

Scope Markets is an internationally renowned Foreign Exchange broker with a great overall offering such as very tight spreads, low commission charges, fast execution speeds, high leverage availability and a save trading environment. Even though they are not regulated by one of the larger regulators like ASIC, CySEC or the FCA, they are a trusted and reliable broker that we can highly recommend.